The Registered Retirement Savings Plan (RRSP) 101: the real guide we should have been given

A real world breakdown of how RRSPs actually work, explained way better than any bank brochure you have ever been handed.

Let’s be real: the Registered Retirement Savings Plan (RRSP) is one of those accounts everyone tells you to open, but almost no one explains. You hear buzzwords like tax deduction, retirement planning, save now thank yourself later, and every February people start screaming about the RRSP deadline like it is the Super Bowl of banking - with Rihanna doing the halftime show. But what does any of that actually mean in real life?

Let me break it down in a way that finally makes sense.

So what is an RRSP, really?

Think of it as a government approved retirement bucket. You put money in, you get a tax break today and your investments grow quietly in the background without the government taking a cut every year. It is a long term planting season for future retired you.

How much you can put in

Your contribution room is based on 18% of last year’s income (in 2025 this limit is $180,500 based on 2024 income, which comes up to a contribution limit of $32,490), up to a yearly limit set by the government.

Most people are shocked when they check their CRA account and realize they have a mountain of unused room. It carries forward forever, so nothing disappears if you miss a few years.

And don’t forget the RRSP grace period — the first 60 days of each year still count for the prior tax year (which is why “RRSP season” happens at the start of every year).

Why the tax deduction matters

This is the juicy part. Every dollar you put in lowers your taxable income, and the higher your income, the sweeter this deduction becomes.

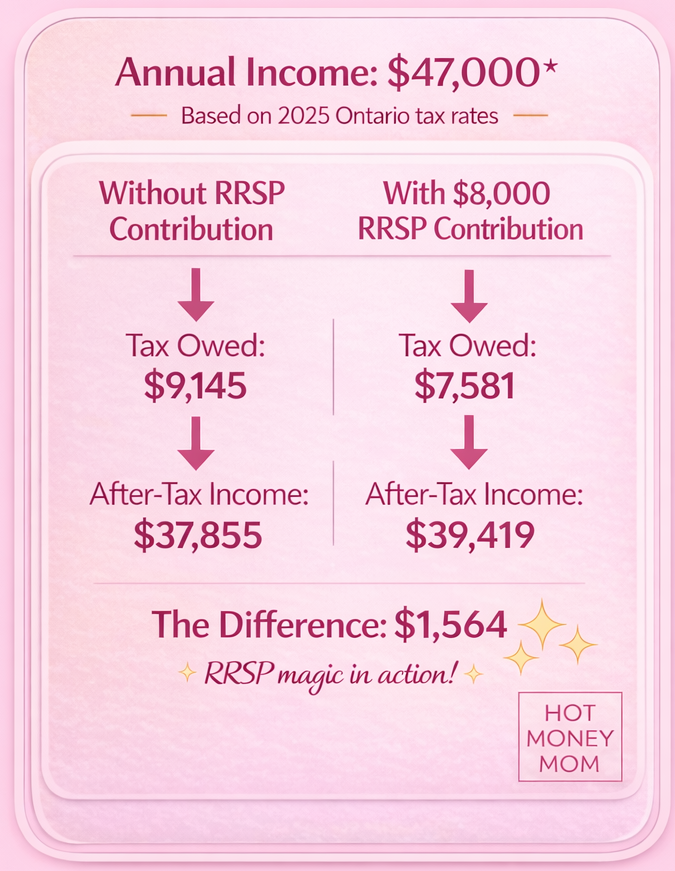

Let’s look at what an $8,000 RRSP contribution can do at two different income levels — $47,000 and $120,000 — using 2025 Ontario tax rates. Note that these numbers are approximate and meant for illustration purposes only:

As you can see, the higher your income, the further your contributions go since they bring down the portion of your income that is taxed. Also, to run your own calculations, refer to my Resources page for an income tax calculator.

When the RRSP is actually worth it

This is where people get it wrong: the RRSP is not universal. It shines for people who earn a solid income today and expect to earn less in retirement. You get a big tax break now and ideally pay a smaller one later when you withdraw. That is the entire strategy in one sentence.

When your income is lower, such as when you are student or on maternity leave, RRSP contributions tend to deliver limited value because they will only provide a small tax break. In your lower earning years, the TFSA is often a better choice if you manage to save. Holding onto your RRSP room for higher earning era is wiser. You must also evaluate your goals: if you are planning on owning a home some day, the FHSA is usually the better choice.

Ideally, your tax refund can be used to fund your next RRSP contribution year over year for a nice snowball effect.

Every February people start screaming about the RRSP deadline like it is the Super Bowl of banking - with Rihanna doing the halftime show.

The parts absolutely no one talks about, especially banks

An RRSP is not free money. It is tax delayed money: and this reality only hits a lot of people once they retire. The government will collect eventually: everything you withdraw in retirement counts as taxable income.

And here is the next plot twist:

By the end of the year that you will turn 71, the government forces your hand: your RRSP must convert into a RRIF (Registered Retirement Income Fund), and you can no longer contribute;

At age 72 you must start withdrawing a minimum percentage every year;

These withdrawals can push you into a higher tax bracket depending on your income, and you will be taxed on them;

Banks tend to whisper this part, for obvious reasons.

Also, RRSP money is not play money. It is basically locked in. You can withdraw, but the tax bill will meet you at the door, and the contribution room you built is gone forever. There are a few exceptions, for example you can withdraw up to a certain amount for a home purchase and pay it back over time (more on that in another post), but overall the RRSP is built for future you, not surprise expenses. Only contribute what you can genuinely leave untouched.

Should you contribute?

Here is the honest version: the RRSP is amazing when your income today is higher than it will be later in life. It is amazing if you invest your tax refund instead of spending it. It is amazing if you want decades of tax-sheltered compounding.

It is less amazing if you are early in your career with a lower income or if flexibility matters more to you than tax deductions. In that world, the TFSA often steals the spotlight, and the FHSA is even better if you plan to buy a home (read my articles on those).

The real magic of the RRSP

The power is not the account: it is the compounding that happens inside it without yearly tax drag. So once again, it is not enough to contribute, you must invest from the account. The longer you let those investments simmer, the larger your retirement pot gets. When used correctly, the RRSP can save you thousands in taxes and create serious long-term wealth.

Where to open an account

Hot Money Mom loves low fee platforms like Questrade and Wealthsimple to open accounts because they save fees that would be charged by a financial advisor & banks.

You can receive $25 when you open your first account with Wealth Simple by using this link or by using code I7YVD2.

More information on the RRSP (including calculators your marginal tax rate after RRSP contributions) visit on my Resources page. Please refer to the Government of Canada’s website for more in-depth info.

So mamas, are you contributing to your RRSP ?